Strategic Integration | Private Equity Software and Your Firm

Private equity software – a crucial tool that enhances financial institutions’ operations, surpassing traditional methods, optimizing performance, and enabling data-driven decision-making. Its applications span sectors such as private equity, venture capital, real estate, and alternative assets. Notably, its adaptability distinguishes it – to be customized to align with specific needs, enabling the selection of features, functions, and integrations tailored to your unique business goals. Unlike one-size-fits-all solutions, private equity software is a flexible asset that evolves with your organization’s changing requirements, providing a competitive advantage for financial institutions.

Advantages of Private Equity Software

| Operational Efficiency |

| Augmented operational efficiency is achieved as the software streamlines processes and optimizes resource allocation. This eradicates inefficiencies, promoting seamless workflows. |

| Informed Decision-Making |

| Private equity software acts as a data-driven compass, providing real-time insights and predictive analytics. This empowers organizations to make informed decisions, reducing risks and capitalizing on opportunities. |

| Competitive Hegemony |

| In a competitive environment, it gives financial institutions a clandestine edge, enabling them to outmaneuver rivals, enhance their market presence, and strengthen their position in private equity investments. Speed and precision are paramount in financial success. |

Challenges in Integrating Private Equity Software

Software that caters to private equity investors is a powerful tool for financial institutions, but it also comes with some challenges and complexities. To integrate it successfully, you need a reliable partner like LenderKit, who can offer you expert guidance and support. Some key integration issues that you may face are:

- Navigating Complexity: The intricacies of software integration are akin to navigating a labyrinth without a guide. Successful integration demands meticulous planning, expert execution, and robust change management. These complexities may deter financial institutions from embarking on the transition.

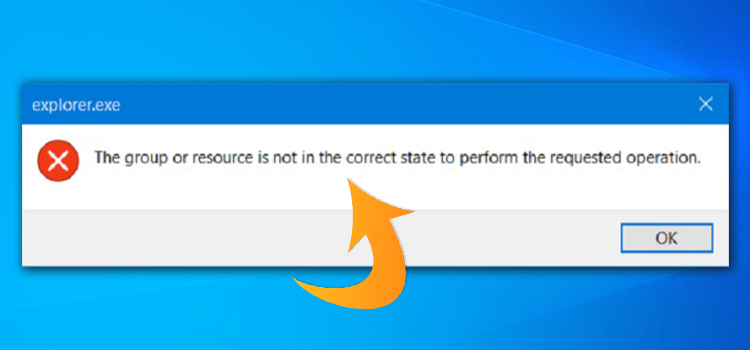

- Data Security Paramountcy: In an era rife with data breaches and cyber threats, the protection of sensitive information weighs heavily on decision-makers. This profound responsibility can discourage organizations from adopting innovative software solutions, despite their transformative potential. To address these concerns, robust security measures are essential. These include:

- Encryption: Data security’s foundation, encryption safeguards information like a well-protected chest, accessible only with the decryption code.

- Routine Audits: Similar to regular health check-ups, these audits ensure compliance, reveal vulnerabilities, and allow for timely fixes, forming a crucial aspect of overall security.

- Customization Imperative: Off-the-shelf solutions typically fall short of meeting the intricate needs of financial institutions. Prefabricated alternatives often necessitate extensive customization, a process that can be protracted and costly. Organizations seek solutions that seamlessly integrate with existing infrastructure while catering to unique business requirements.

Customization Modalities:

| Customization Type | Description |

| Modular Design | In software, it’s like assembling with interchangeable components. Organizations can tailor software to exact needs by adding or removing modules. This ensures adaptability, scalability, and responsiveness to market shifts. |

| Scalability | Like an organism adapting, it signifies software’s seamless growth with evolving needs. It enables expansion, client onboarding, and new features without extensive redevelopment, with efficient utilization depending on competence and expertise. |

Strategic Integration Solutions:

- API Integration

This modality is akin to constructing a bridge between divergent systems, enabling the seamless flow of data akin to tributaries converging into a mighty river. It necessitates a meticulous understanding of existing system architecture, data mapping, and comprehensive testing to ensure the smooth transfer of information. Read CGAP to understand if APIs make sense for your business.

- Hybrid Approach

The hybrid approach represents a harmonious blend of tradition and innovation. It allows financial institutions to retain their core systems while integrating new, flexible solutions that mirror the unique exigencies of the organization. This approach is especially valuable when legacy systems hold substantial historical data and processes that remain operationally critical.

Implementation of Private Equity Software

The process involves three critical components:

- Selecting the Right Software: Like choosing a custom-made outfit, organizations must meticulously evaluate software options. Consider factors such as alignment with specific goals, scalability, and vendor reliability. Vendors like LenderKit, known for their comprehensive offerings, maybe a suitable choice.

- Training Staff: Just as aviators undergo comprehensive training, the organization’s workforce must prepare to navigate the software proficiently. This goes beyond procedure; it’s crucial for realizing the software’s full potential. Staff should gain a deep understanding of its capabilities, impact on daily operations, and data interpretation nuances.

- Continuous Improvement: In a continually evolving financial landscape, stagnation is akin to quicksand. Organizations should foster a culture of ongoing improvement in software integration. Regular performance assessments, adaptation to market dynamics, and user feedback collection form the foundation of sustainable success. This approach ensures that the software continues to meet evolving needs and drives success.

Measuring Success and ROI: Key Performance Indicators (KPIs)

Implementing software for private equity in financial organizations poses the challenge of assessing its success and return on investment (ROI). While this software offers benefits like improved operational efficiency and enhanced portfolio performance, these advantages may not be immediately evident or easily quantified. Their realization depends on factors such as organization size, software complexity, and user adoption.

To gauge success and ROI effectively, financial organizations must define clear, strategic Key Performance Indicators (KPIs). These measurable metrics align with specific objectives and business needs, offering a tangible assessment of goal achievement. Example KPIs for private equity software implementation include:

- Cost savings: The amount of money saved by reducing manual processes, errors, and inefficiencies.

- Revenue growth: The increase in revenue generated by improving deal sourcing, due diligence, valuation, and exit strategies.

- ESG impact: The improvement in environmental, social, and governance (ESG) performance and reporting by using software that enables data collection, analysis, and disclosure.

- User satisfaction: The degree of user satisfaction with the software’s functionality, usability, reliability, and support.

By establishing and tracking these KPIs, financial organizations can evaluate the success and ROI of their private equity software implementation and identify areas for improvement or optimization.

Illustrating Success

Consider the case of a venture capital firm Night Dragon Investments specializes in cybersecurity and embraces private equity software. This forward-thinking organization realized a substantial 30% reduction in due diligence time and achieved a remarkable 25% increase in the rate of successfully closed private capital deals (Bine & Company). This real-world illustration underscores the potential return on investment (ROI) that strategic integration can yield.

Conclusion: Embrace the Future

As we conclude our journey from concept to market entry, let’s revisit our intriguing fact: Strategic integration of private equity software is shaping the future of financial institutions. To address any lingering doubts:

- Strategic integration of private equity software is a dynamic imperative in the world of finance, propelling organizations towards operational excellence and competitive advantage.

- The advantages it offers far exceed the challenges posed by integration, data security, and customization.

- By adhering to best practices and fostering a culture of continuous improvement, organizations can harness the full potential of private equity software to elevate their efficiency, security, and prosperity.

Now, we invite you to embrace the future. Explore and strategically integrate private equity software with trusted partners like LenderKit to propel your financial institution to new heights. It’s not just a tool; it’s your passport to a more efficient, secure, and prosperous future.

Subscribe to our newsletter

& plug into

the world of technology